Value Added Tax (VAT) — is a value added tax in the European Union (EU).

VAT is charged on both physical and digital goods and services. The EU Directive dated January 1, 2015 contains the complete information on regulation of VAT for digital products.

If you specified an EU country when you registered, VAT equal to the country's tax rate will be added to the base price of all goods and services. You can disable the addition of the tax. This is available for legal entity payers with a VAT-number. See below for more details.

Displaying tax on license purchase

Whether the tax is added to the cost of the license depends on the status of the payer. In particular, for EU individuals, tax is always added to the cost of goods and services, and for legal entities — only if there is no VAT. To understand how the added tax is displayed depending on payer status, see the table below.

How to make the cost appear without tax?

To disable adding tax, specify the VAT-number for the payer. You can do this when creating or editing a payer.

To add a VAT-number when creating a new payer:

- Enter Clients → Payers → click Add.

- Select the country.

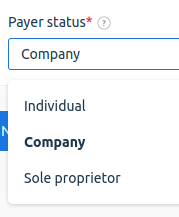

- In the Payer status field, select the payer status.

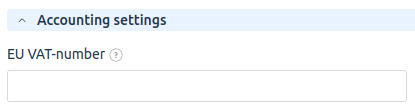

- Specify the VAT number in the Accounting settings → EU VAT-number field:

To add a VAT number for an existing payer:

- Enter Clients → Payers → click Edit.

- Specify the VAT-number in the Accounting settings → EU VAT-number field.

If adding a VAT-number is not available

Adding a VAT number is not available if:

- an individual payer has already been created under the account. Only one payer can be created within a single account. If you have previously created an individual payer, you will need to add a new legal entity payer;

- for a legal entity payer, the VAT-number has been previously filled in and verified.

Changing the payer or editing the VAT number is not available to the user and must be done by contacting technical support:

- Create a new ticket under Support → Support tickets → click Add.

- In the ticket, indicate that you need to add a new payer or make adjustments. Specify the details with the VAT-number.

En

En

Es

Es