BILLmanager allows to provide post-paid and advance services. A service provider can also enable credit limit for his customers.

Advance payment — the billing system charges a client when he orders a service. The client pays for a certain period.

For the convenience of clients, BILLmanager displays the Recommended amount for service activation on the homepage of the client area. This amount is calculated by the panel based on the forecast of expenses for the following month: the cost of services for the rest of the current month and the cost of services for the next month are added up.

Post-paid services — the client can order services on credit, and his account will show a negative balance. On the first of the next month, the system will generate an invoice.

Credit limit — the client can order services on credit, but he cannot exceed the limit that the provider sets for his account. The billing system won't generate the invoice automatically.

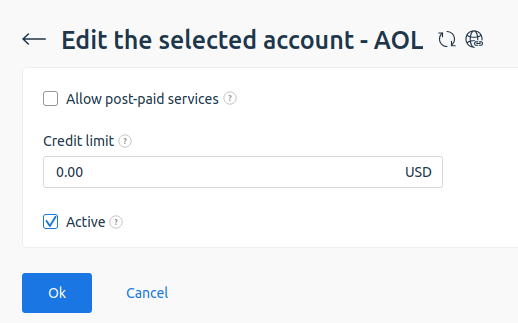

By default, all clients can make only advance payments. If you want to activate post-paid services or set a credit limit, navigate to Clients → Clients → select a client → Account → select an account → Edit:

Might be useful:

En

En

Es

Es