A credit limit is a reserve of funds that allows you to order services on credit for a month. The amount owed cannot exceed the limit and must be repaid within the time limit set by the provider.

To set up the use of the credit limit:

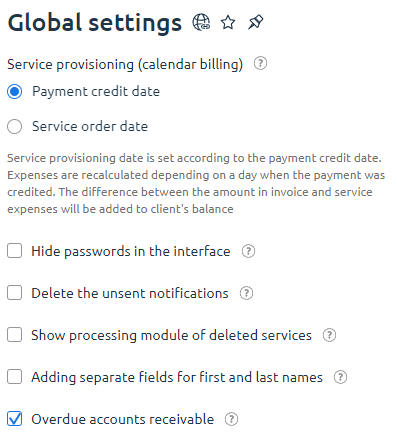

- Enter Provider → Global settings → enable the Overdue accounts receivable option.

- Enter Clients → Clients → select the client → Invoices → select the invoice → Edit button.

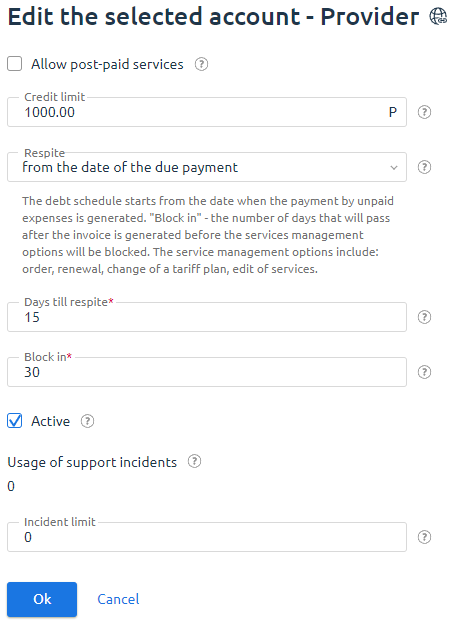

- Disable the Allow post-paid services option.

- Fill in a form to edit the personal account:

- Credit limit — allows the client to go into debt within a specified amount;

- Resplite — the point at which one can go into debt

- unlimited;

- from the date of the due payment.

- Days till respite — the number of days in which the client needs to repay the debt;

- Block in — the number of days after which ordering and renewal will not be available.

The date of blocking of the client's personal account is calculated with the formula: the date of the oldest unpaid invoice + the value of the "Block in" field, which is specified in the client's personal account settings.

For example, an invoice was issued to client on 2022-01-01. The “Block in” field is set to 30 days. The account will be blocked on 2022-01-31.

Statuses for Overdue payment are used for clients with a credit limit:

- no payments;

- there are payments, but the grace period has not expired;

- the grace period has expired but account is not blocked;

- the account is blocked.

Payment Features

- If the client has not yet paid the invoice and does not have any invoices, the client will have a choice of payment methods.

- If the client has already used a payment method and does not have an invoice, only the method used previously will be available for payment.

- If the client has an invoice from a company, only the payment method linked to the company will be available for payment.

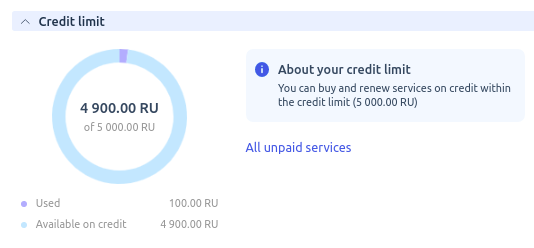

Information about the credit limit

Platform operation with enabled credit limit:

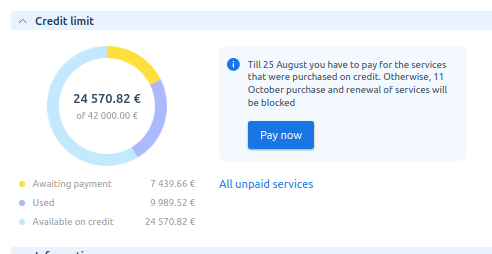

On the first day of each month, the billing platform generates invoices for unpaid expenses over the preceding month. After the invoice is issued, payment must be made by the 15th day of the current month. From the 16th day, the payment becomes overdue. A grace period of 15 days is given to effect the overdue payment.

If the overdue payment is not repaid, the credit limit will become unavailable from the 30th day of the current month.

When the credit limit is blocked, the following actions are not available:

- payment for a service;

- service renewal through the cart;

- auto-renewal from the personal account.

The following actions remain available with a credit limit blocked:

- personal account topup;

- auto-renewal by means of saved payment methods.

The debt is displayed in the client area:

- on the main page;

- in the page header.

You will be notified at the time of billing. If the payment is not received, you will receive notifications:

- three days before the due date;

- the day after the due date;

- five days before the blocking date;

- on the blocking day.

Payment and unblocking

History and invoices are available under Finance and documents.

Blocked services, for which auto-renewal from the personal account is configured, will be enabled automatically once the overdue payment is received.

Invoice information

Invoices issued for unpaid expenses can have one of three statuses:

- payable — the invoice has been issued;

- partly paid — a part of expenses in the invoice has been paid;

- fully paid — all expenses in the invoice have been paid.

Invoice statuses:

- Invoice issued.

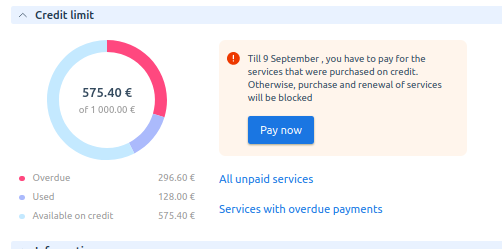

The following are displayed on the dashboard:- schedule with details of credit limit expenses;

- details of the invoice issued indicating the due dates;

- information about service blocking in case of payment overdue.

- Invoice not paid until grace period expiry date.

Amounts displayed on the dashboard:- available — balance of available credit limit;

- overdue — amount of unpaid invoices;

- not paid — amount of expenses for services purchased on credit after the first issued invoice

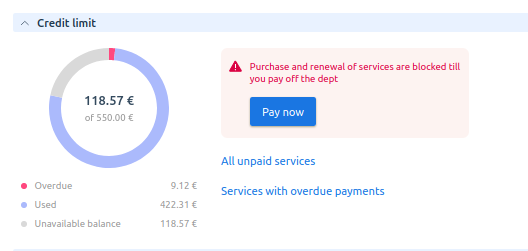

- Debt not paid.

A message is displayed on the dashboard: "Renewal and purchase of services are blocked until the debt is paid in full”.

More settings

Sending notifications

Notifications are sent out to clients on a daily basis. A task in the cron scheduler is responsible for sending out notifications:

1 0 * * * /usr/local/mgr5/sbin/billmaintain --command send_debt_notification >/dev/null 2>&1One of the following notifications can be sent to a client when the mailing is started:

- a notification to repay the debt;

- a notification on payments overdue;

- a notification on blocking the services due to debt.

To edit notification templates, enter Settings → Message templates → select Email messages → click Templates → select templates from the list → click Edit.

Example

- Invoice date: 2022-12-01.

Grace period: 15 days

Value of the DayBeforePaydateForDebtWarning parameter: 3 days.

A notification to pay the invoice will be sent on 2022-12-12.

- Invoice date: 2022-12-01.

Grace period: 15 days

Value of the DayAfterPaydateForDebtExpiredWarning parameter: 3 days.

A notification of payment overdue will be sent on 2022-12-18.

- Invoice date: 2022-12-01.

Blocking: 30 days

Value of the DayBeforeBlockedForDebtWarning parameter: 3 days.

A notification on pending blocking will be sent on 2022-12-27.

En

En

Es

Es