You can refund payments that do not have expenses linked to them. Expenses are the funds that the client has spent to purchase services. If the amount is changed or the expense is deleted, the funds are returned to the client's personal account in the client area. Refunds are available in the amount by which the expense was changed or deleted.

BILLmanager supports two refund methods:

- automatic;

- withdrawal of funds from the client's account.

Automatic refund

Automatic refund allows you to refund all or part of the funds credited to the client's account by the selected payment. It is only available for payments that have been credited through a payment method with a refund option.

Automatic refunds are available for the following payment methods:

- Adyen

- Alipay

- BitPay

- Liqpay

- Paybox

- PayMaster

- Payment.Center

- PayPal Checkout (Outdated API)

- Portmone

- Skrill

- Stripe

- T-bank

- YooMoney (for individuals)

To allow refunds:

- Enter Provider → Payment methods → select a payment method → click Edit.

- Enable the Allow refunds option.

To process a refund:

- Enter Billing → Expenses → select an expense → delete the expense completely or adjust the amount.

- Enter Billing → Payments → select the payment for which you changed the expense → click Refund.

- Fill in the form:

- Refund — specify the amount that will be refunded to the client.

- Reason for refund.

If a full refund has been made, the payment will assume the status "Refunded". If a partial refund has been made, BILLmanager will create a negative payment for the amount of the refund to adjust the balance.

Withdrawal of funds from the client's account

Withdrawal of funds from the client's account is only available via bank transfer or a customizable payment method.

To make a withdrawal from the personal account:

- Enter Billing → Expenses → select an expense → delete the expense completely or adjust the amount.

- Enter Clients → Clients → select a client → click Accounts.

- Select an account → click Refund.

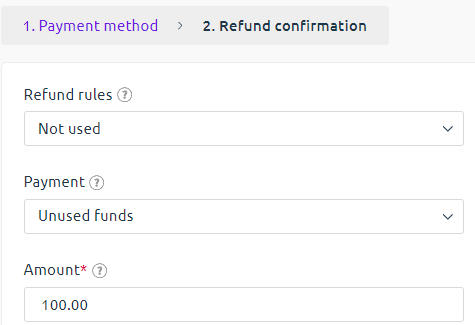

- Fill in the form:

- Payment method — the payment method by which the refund will be made. A negative payment will be created with the specified payment method.

- Refund rules — Select the rule that determines the amount of the withdrawal fee.

- Payment — select the payment from which you want to perform a refund. All credited and unspent advances are available for selection.

- Amount — enter the amount of the refund.

To adjust the balance, BILLmanager will create a negative payment for the refund amount to debit the funds that were returned to the client's account after the expense was changed or deleted.

Return rules

The provider may charge a fee when refunding funds to the client. The amount of the fee is governed by the refund rules.

To add a rule, enter Settings → Refund rules → click Add:

- Name — specify the name for the refund rule.

- Fee amount — specify a fixed commission amount. Specified in the provider's currency. If the field is not filled in, no fixed commission will be charged.

- % from refund — specify the percentage rate of the commission charged. If the field is not filled in, no percentage rate will be charged.

- Calculate amount of refund — select the rule for calculating the total commission amount. Enabled if the fields Commission amount and % of refund amount are filled in.

- % + amount — calculated according to the formula: (refund amount / % of refund amount) + Commission amount.

For example, a provider has processed a refund to a client using the so called "10 + 10" rule. The amount of refund is 200 USD. The commission amount will be 30 USD ((200 / 10) + 10), including: refund amount 20 USD - 10% of 200 and 10 USD - fixed commission. - amount + % — calculated according to the formula: Commission amount + ( (refund amount - Commission amount) / % of refund amount).

For example, a provider has processed a refund to a client using the so called "10 + 10" rule. The amount of refund is 200 USD. The commission amount will be 29 USD (10 + (200 - 10) / 10%), including: 10 USD - fixed commission and 19 USD - 10% of 190. Commission amount - 10 USD, % of refund amount - 10%.

- % + amount — calculated according to the formula: (refund amount / % of refund amount) + Commission amount.

- Expense name — specify the name for the commission withdrawal expense.

Peculiarities of refunds for addons to the tariff

- Automatic calculation of refunds is not possible if a change of tariff with an additional payment has been made for the service. In this case, reducing the value of additional resources will not start the automatic refund process. BILLmanager will open a task to manually calculate amounts to be refunded.

- If an additional resource to the tariff has been paid for, but its current price is zero, a refund will be made if the value of this resource decreases.

- When calculating refunds, the entire paid period is taken into account. For example, a month of using a service with a paid addon has been paid. The service was active for half of that period. If the addon size is reduced, the refund calculation will include the cost of the entire period, not the remaining portion.

En

En

Es

Es