This article contains frequently asked questions about Hosting&Cloud pricing.

Switching to Hosting&Cloud tariff

We have updated the BILLmanager Advanced edition to Hosting&Cloud, but creating a new provider is not available to us. Why is that?

All BILLmanager features are available for the Hosting&Cloud edition. If some options are unavailable, most likely the update was performed incorrectly. For more information about the update process, see the article Transition between versions of BILLmanager 6 in the BILLmanager 6 documentation.

Repeat the update procedure with the command:

/usr/local/mgr5/sbin/billmgr-upgrade.sh corporateAfter updating again, check for additional features. If the new menu sections are still unavailable, possible problems with the update are described in the article Problems with platform update. If the problem cannot be resolved, please contact our technical support via your client area under Support → Support tickets → Add.

The trial version of BILLmanager 6 Hosting&Cloud has a limit of 10 users. Are we talking about 10 clients that can place orders or are internal users also taken into account?

The system considers all clients from the BILLmanager Clients → Clients section, including inactive clients.

Tariffs

How does the new scheme of billing based on turnover work?

With monthly billing you purchase a license at a minimum cost of €50 and the system takes into account your turnover during the current license period. If you have exceeded a turnover of more than €5 000 in a period, the additional extension of the license is made on a postpaid basis within 15 days from the end of the license period.

With an annual tariff, license prepayment is made. You choose the range in which your planned turnover for the year falls and pay the cost of the license. For example, your annual turnover is planned from €240 001 to €360 000, then the cost of the annual license will be €3 600. If this limit is exceeded, you must purchase a license extension within 15 days of exceeding it. In your client area, the system will advise you of the current turnover and the cost of extending the license.

Is the renewal based on the calendar or the actual period?

Monthly licenses operated based on calendar withdrawals, while annual licenses are based on the fact.

- the cost of payment for calendar withdrawals is calculated as follows:

- If there are less than 15 days left until the end of the month, the cost of the license will be 1 month + a pro rata balance of €50. For example, if you purchase a license on June 20, the license will be extended until August 01 and the payment will be €68,34;

- if there are more than 15 days left until the end of the month, the cost of the license will be a pro rata balance of €50. For example, if you purchase a license on June 05, the license will be extended until July 01 and the payment will be €43,16. The first turnover will be counted for the same period.

- if you purchased an annual license on April 20, 2023, it will be valid until April 20, 2024, which is an actual year.

License cost

If a one-month license is purchased on April 22, what will the cost be?

In this case, the license will be extended until June 1 and the payment will be €65. The payment amount includes payment for the period from April 22 to May 01 (€15) and payment at the minimum rate for one calendar month of May (€50). In case the turnover limit is exceeded (turnover above €5 000), there will be an additional charge and a license fee for June. If there is no excess, the payment for June will be €50.

Your website states that for turnover between €10 001 and 20 000, the final license fee will be €200. Does this amount change depending on the exact turnover? For example, if my turnover was €16 000, will the final cost be €160 or €200?

The cost of the license does not depend on the specific amount of turnover. Only the range in which this amount falls is taken into account.

In the above example, the calculation will be done according to the calculator on the website. If the turnover was €16 000, the license payment will consist of the following amounts:

€50 — the minimum license fee;

€150 — license extension fee.

The total cost of the license will be €200.

Turnover

Where can I see my turnover?

You can see your turnover:

- in your client area under Products/Services → Licenses → Turnover;

- in the BILLmanager platform on the Home → License information → Actual turnover.

What happens if the turnover changes during the paid license period?

If the turnover increases, the system will offer to purchase an extension to the license limit.

If the turnover decreases, you can buy a license for the next period with a reduced limit.

What if I do not know my turnover when I buy an annual license?

In this case, you pay the minimum cost for the year (€600), and then BILLmanager will send a notice about exceeding the limit and the need to pay within 15 days.

Can I choose a turnover range for a monthly renewal?

No, you cannot. For a monthly renewal, you always pay the minimum license fee, and if you exceed the limit, you pay on the post-payment basis. At the end of the reporting period, BILLmanager calculates your actual turnover for paid expenses and issues an invoice to pay for the license extension up to the actual turnover. The invoice must be paid within 15 days of issuance.

What is necessary on my part for you to receive turnover data?

In order for the turnover to be calculated correctly:

- Open port 8443. This is necessary for the transfer of statistics on the company's turnover and the correct calculation of the tariff plan.

- Update BILLmanager to the current version. BILLmanager version 6.76 or higher is required for correct calculation of turnover. For update instructions, see the Installation and updates in BILLmanager documentation.

What if I do not have the ability to provide you with turnover data?

If BILLmanager does not receive data on turnover, the license is paid at the maximum rate. See our website for tariffs.

Test payments in turnover

Which payments in BILLmanager are considered test payments?

These are payments that are created under test users, manually credited and go to pay for test services.

Are test payments factored into turnover when calculating license fees?

BILLmanager does not distinguish test payments from real ones, so all payments in the status Paid are accounted for in the turnover.

If the test payments for September are deleted in October, in what month will those adjustments be recognized?

These changes will be accounted for in the October excess invoice. This invoice will be generated on the first of November. Recalculation for past periods for which an invoice has already been generated is not performed.

If a test client has a 100% discount activated, will their orders be included in the turnover calculation?

The system only recognizes paid expenses in the accounting period. If a client has a 100% discount set, no expense will be created and nothing will be included into turnover.

What are some guidelines to help avoid test payments from being included into circulation?

To exclude your test payments from being included in the turnover calculation:

- Delete test service expenses under Billing → Expenses.

- Delete test payments under Billing → Expenses or set them to New status.

Price recalculation

If a refund is made, will there be a recalculation of the cost of the license?

If a payment or a part of a payment is returned due to an incorrect expense, the turnover is recalculated during the reporting period. If the period is calculated and paid, there is no recalculation.

If an expense is deleted or changed in the current month, in which period will these changes be included in the calculation of turnover?

An invoice for exceeding the current month's turnover limit will be generated on the first day of the following month. This invoice will reflect these changes. Once the excess is billed, the turnover is recalculated. According to this calculation, the license fee for the next period may change.

Exceeding the limit

How much time do I have to pay for exceeding the limit?

15 calendar days from the date of the invoice for exceeding the limit.

Will I be charged for exceeding the limit automatically?

Yes. BILLmanager will automatically generate a charge for exceeding the limit and the funds will be deducted from your personal account balance. If there are not enough funds on the balance, a negative deduction will be made. Funds will be deducted as a negative amount, even if there is no credit limit, because the expense is created after the service is used.

What if I pay for the license renewal before I get the invoice for the extension?

For a monthly license, an invoice for the license extension is issued at the end of the reporting period (01 day of the next month). If the license has already been renewed, payment of the excess will be deducted from that amount.

Example: On May 31 the service was renewed for the following month, until June 30. In May, the turnover was €11 000 and the license extension was invoiced on June 01. The license fee in this case will consist of the following amounts:

- €50 minimum cost payment made on May 31;

- €150 — payment for the license extension invoiced on June 01.

The total cost of the license will be €200.

If payment for the extension bill is not received within 15 days, the following options will be blocked until payment is received:

- creating new clients;

- creating new tariff plans;

- renewal of the service for further periods.

For an annual license, the renewal is not automatically invoiced. You need to manually change the turnover range and pay the new value. If the license has already been renewed for the following year, the excess is payable on a pay-as-you-go basis in the current period.

For example, when purchasing a license, a turnover range of €60 001 to €120 000 was selected and paid for. After 8 months, the total turnover amounted to €120 000. The difference between the previous and new turnover range must be paid within 15 days.

If payment is not received within 15 days of exceeding the limit, the following features will be blocked until payment is received:

- creating new clients;

- creating new tariff plans;

- renewal of the service for further periods.

How to pay for exceeding the turnover limit?

The algorithm for paying for license renewal when the limit is exceeded differs depending on the tariff.

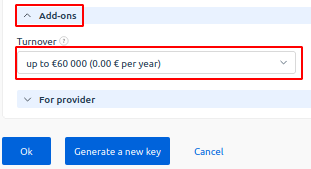

For an annual license, if the limit is exceeded, a new turnover range must be manually selected and paid for:

- In your client area, select the required license under Products/Services → Licenses.

- From the top menu, click Edit to enter edit mode.

- In the Add-ons block, select the new turnover range and click Ok.

- Pay for the new turnover range.

For a monthly license, the license renewal will be billed automatically. If there are not enough funds on your personal account for payment, a negative balance will be formed. To pay the bill, top up the balance by the required amount.

En

En

Es

Es